Home

Welcome

Welcome to Trinity Research in Social Sciences (TRiSS) the unifying location for social science research in Trinity connecting our world class social science researchers across multiple disciplines for the purposes of collaboration.

TRiSS News and Events

TRiSS Econs students win IEA Prizes

Congratulations to Doireann O'Brien and Bhavya Shrivastva who were both awarded prizes at the Irish Economic Association Conference 2025

Promotion for TRiSS Director!

Congratulations to TRiSS Director, Ronan Lyons, who has been promoted to Professon In Economics

TRiSS Research Fellowships 2025/26

Applications for a TRiSS Research Fellowship 2025/26 are now being accepted

TRiSS Director awarded Research Ally 2024 prize

Congratulations to Ronan Lyons for his Research Ally 2024 prize.

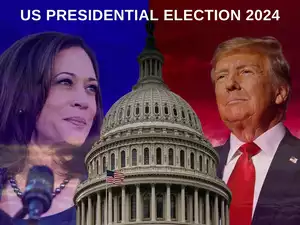

Bitesize Discussion and Pizza: The US Election 2024, Wed 13 November, 1pm

Join us on Wed 13 Nov, 1pm, at the TRiSS Seminar Room to take part in a Q&A session and discussion on the US Presidential Election 2024.

Bitesize Talk and Pizza: Technology and Society, Wed 1 November, 1pm

Bitesize Talks and Pizza are back! Join us on Wed 1 Nov, 1pm, at the TRiSS Seminar Room to hear a snapshot of social science research projects.

TRiSS Travel Bursaries

Reminder, the deadline for TRiSS Travel Bursaries is Friday 20 October, 5pm

Prof Tannam's OpEd in Irish Times

Read the OpEd by Prof. Etain Tannam on the Windsor Framework in the Irish Times

IRC Research Ally Awards

Congratulations to the TRiSS academics who were presented with an IRC Research Ally Award

Young Irish Economists hold inaugural session October 6 2022

Xidong Guo will be the first speaker for the YIESS series. He will present his paper "Assessing the Outcome of the 2008 Consultants’ Contract Reform in Ireland.

TRiSS Scholar wins Young Economist Award

Laura Muñoz Blanco was awarded the 2022 EEA Young Economist Award for her paper on the relationship between child/early marriages and natural disasters

TRiSS Fellowship Awards 2022/23

Congratulations to the academics and postgraduate students who have been awarded a 2022/23 TRiSS Fellowship

Dermot McAleese Teaching Awards 2021/22

Well done to TRiSS winners and nominees of the Dermot McAleese Teaching Awards.

TRiSS New Fellows

Congratulations to all the TRiSS affliated Fellows announced on Trinity Monday.

€3.8m funding secured by Economics Dept

Trinity economists, in collaboration with colleagues in Queen’s University Belfast, have been awarded €3.8 million to establish an All-Ireland Centre of Excellence in Economics, History and Policy.

TRiSS Director celebrated at Trinity Innovation Awards

Click here for details.